Supplier Credit

1. Borrowers

- exporter of goods, works or services (hereinafter: the supplier) who has concluded an export contract with a foreign buyer

Pursuant to the Conflict of Interest Prevention Act (Official Gazette of the Republic of Croatia Nos. 26/11, 12/12, 126/12, 57/15) and all subsequent changes and amendments, restrictions are in force on lending to business entities whose ownership interests are owned by public officials and their family members. The provisions of these restrictions are deemed a constituent part of HBOR loan programmes. The full wording of the restrictions can be found at: Restrictions on Lending to State Officials.

2. Purpose of Loans

- financing exports of goods and services, except consumer goods, pursuant to the rules determined by the OECD Consensus

3. Manner of Implementation

- direct lending

4. Loan Amount, Disbursement Period and Repayment

| Loan amount |

|

| Disbursement period |

|

| Repayment period |

|

5. Interest

| Fixed interest rate | CIRR + margin Margin on CIRR ranges from 0.2%, depending on the creditworthiness of the supplier, the buyer, the export transaction and the importing country. |

| Variable interest rate | LIBOR/EURIBOR + margin Margin depends on the creditworthiness of the supplier, the buyer, the importing country and the export transaction. |

6. Loan Application Fee

0.5% one-off, charged on the contracted loan amount

7. Commitment Fee

- 0.25% p.a. charged on the undisbursed loan amount

8. Security

- policy insuring direct deliveries of goods and services assigned to HBOR

- assignment of accounts receivable under the export contract

- other acceptable security

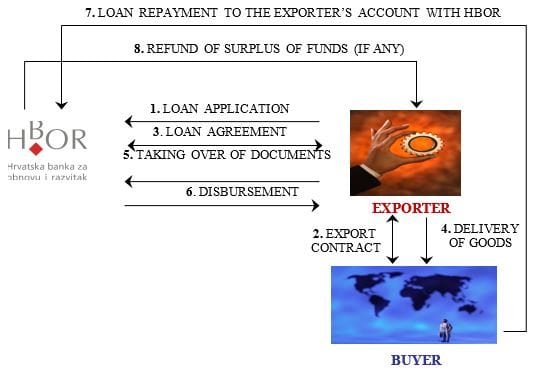

9. Scheme

The supplier concludes an export contract with the foreign buyer to sell goods, works or services on credit. Loan funds are disbursed directly to the account of the supplier in the currency of the export contract. The foreign buyer repays the loan to the supplier, and the supplier to HBOR.

FAQ

FAQ