Insurance of performance-related export guarantees

If you are, as an exporter, confronted with the need for guarantees issued in favour of your foreign buyers as a condition for entering into or performing export contracts, and if you are at the same time not able to offer usual or sufficient collateral to your bank required for the issuing of a guarantee, you can enter into a contract with HBOR providing insurance of guarantees.

All commercial banks in the Republic of Croatia and Hrvatska banka za obnovu i razvitak can be beneficiaries of insurance policies provided that they have experience in the guarantee business.

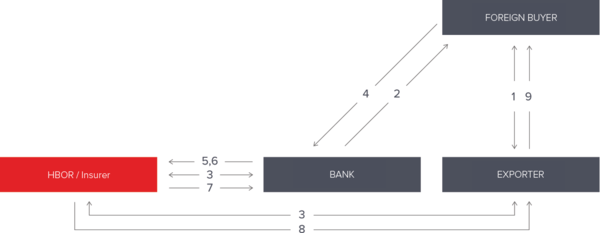

1. The exporter concludes an export contract with the foreign buyer.

2. The bank issues a guarantee in favour of the foreign buyer at exporter’s order.

3. The bank and the exporter conclude an insurance contract with the Insurer.

4. The foreign buyer collects payment under the guarantee.

5. The bank sends to the Insurer a notification about the payment under the guarantee (30 days).

6. The bank submits to the Insurer a claim upon the lapse of 30 days from the delivery of the payment notification.

7. The Insurer submits to the bank a statement on the indemnity within the period of 45 days from the receipt of a complete claim and pays indemnity within the period of 15 days from the notification.

8. In case of a fair calling for payment under the guarantee due to the non-fulfilment of the export contract by the exporter, the Insurer collects payment from the exporter upon the payment of indemnity.

9. In case of an unfair calling for payment under the guarantee or if a call for payment is caused by political risk or force majeure, the Insurer shall not collect payment from the exporter, and the exporter shall initiate actions against the foreign buyer or third persons in order to collect payment for loss.

General Terms and Conditionsditions

All commercial banks in the Republic of Croatia and Hrvatska banka za obnovu i razvitak can be beneficiaries of insurance policies provided that they have experience in the guarantee business.

Advantages of an insurance policy

- Insurance policy for guarantees is a quality and acceptable collateral for placements in terms of its price (a policy replaces or supplements collaterals that are usually taken by a bank for issuing of guarantees) for banks that guarantees compensation for a loss in a short time period when the bank effects payment under the guarantee upon the beneficiary's call for payment.

- The programme provides the possibility of insurance of all types of performance-related guarantees or counter-guarantees relating to the conclusion or performance of an export contract.

- Besides giving the possibility to exporters to increase their debt with banks, the Programme for the Issuance of Performance-Related Bank Guarantees also provides protection to exporters against losses in cases when calls for payment under the guarantee occur in spite of due fulfilment of exporter's obligations or as a result of occurrence of a political risk or force majeure.

- The insurance cover can be generally contracted to the maximum amount of 80%, depending on the creditworthiness of exporter.

Insurance scheme

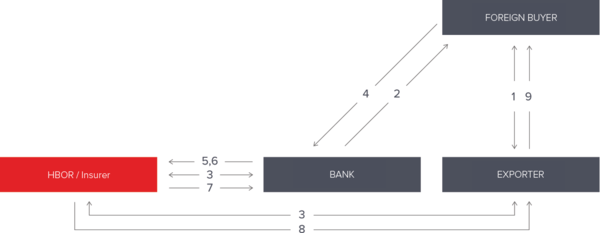

1. The exporter concludes an export contract with the foreign buyer.

2. The bank issues a guarantee in favour of the foreign buyer at exporter’s order.

3. The bank and the exporter conclude an insurance contract with the Insurer.

4. The foreign buyer collects payment under the guarantee.

5. The bank sends to the Insurer a notification about the payment under the guarantee (30 days).

6. The bank submits to the Insurer a claim upon the lapse of 30 days from the delivery of the payment notification.

7. The Insurer submits to the bank a statement on the indemnity within the period of 45 days from the receipt of a complete claim and pays indemnity within the period of 15 days from the notification.

8. In case of a fair calling for payment under the guarantee due to the non-fulfilment of the export contract by the exporter, the Insurer collects payment from the exporter upon the payment of indemnity.

9. In case of an unfair calling for payment under the guarantee or if a call for payment is caused by political risk or force majeure, the Insurer shall not collect payment from the exporter, and the exporter shall initiate actions against the foreign buyer or third persons in order to collect payment for loss.

General Terms and Conditionsditions

FAQ

FAQ