Pre-export financing insurance

If you are an exporter faced with the lack of working capital for the production of goods for exports, and you are not able to offer customary loan collateral to your creditor, you can arrange an insurance policy serving as collateral for pre-export financing with HBOR.

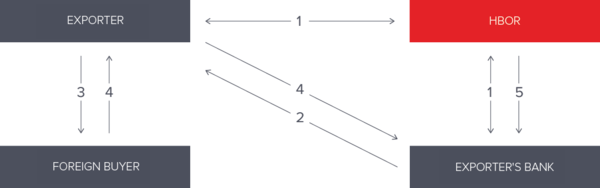

1. HBOR, the bank and the exporter conclude the insurance contract.

2. The Bank approves the loan to the export for pre-export finance.

3. The exporter uses the loan funds and manufactures the goods that are then delivered to the foreign buyer.

4. The foreign buyer pays for the goods to the exporter. The exporter repays the loan from its inflows from abroad.

5. If the exporter does not repay the loan, HBOR pays indemnity to the bank.

General Terms and Conditions

Beneficiaries of insurance

- Exporters that are duly registered and operate successfully;

- They generated income from sale in the foreign market in the period of at least 1 year;

- They have a concluded and legally valid export contract with a foreign buyer;

- The bank has assessed favourably the exporter’s creditworthiness.

Advantages of an insurance policy

- The exporter provides working capital necessary for the realisation of agreed export transaction;

- It is possible to insure from 60% up to 80% of the receivables based on principal and ordinary contractual interest;

- The bank is insured against non-performance of obligation under the loan contract;

- The premium rate depends on credit rating of the exporter, maturity and loan collaterals as well as the insurance policy coverage;

- Waiting period of not more than 2 months is a warranty of the indemnity payment in short term.

Insurance scheme

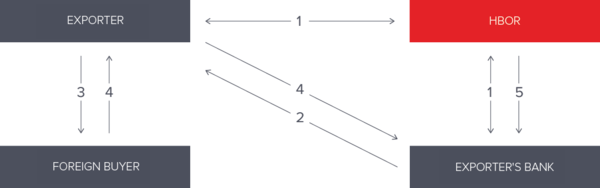

1. HBOR, the bank and the exporter conclude the insurance contract.

2. The Bank approves the loan to the export for pre-export finance.

3. The exporter uses the loan funds and manufactures the goods that are then delivered to the foreign buyer.

4. The foreign buyer pays for the goods to the exporter. The exporter repays the loan from its inflows from abroad.

5. If the exporter does not repay the loan, HBOR pays indemnity to the bank.

General Terms and Conditions

FAQ

FAQ